HK

HK

Sending money from the UK to Canada? It doesn't have to be complicated or costly. Whether you're supporting a loved one, paying for services, or managing business transactions, understanding your options can help you save both time and money.

This simple guide breaks down everything you need to know, highlighting the best methods whether you prioritise speed or cost-effectiveness. We’ll also offer tips to help you make the right choice, all while ensuring your money reaches its destination safely.

Methods we cover:

Let’s get started.

When sending money from the UK to Canada, you have two main options: traditional bank transfers or online money transfer services. Understanding the differences between these options first can help you decide which is the best fit for your needs, considering factors like speed, cost, and convenience.

Many UK banks offer international transfer services to Canada, typically using SWIFT for bank-to-bank transfers. A bank transfer is often seen as a traditional and reliable option due to the long-standing trust in banking institutions and their robust security systems. You can initiate the transfer in the banking apps, over the phone, or at a branch.

However, this method may come with higher costs and potentially less favourable exchange rates than newer alternatives. Another challenge with bank transfers is that they can be harder to track than digital transfer methods. While banks do offer tracking options, they are typically not as user-friendly or as real-time as the tools provided by digital platforms.

Still, some UK banks, such as Starling Bank, have modernised their offerings and provide more competitive international transfer services.

Online money transfer services are digital platforms that allow individuals and businesses to send money across borders. Accessible through websites or mobile apps, they enable transfers to recipients' bank accounts, mobile wallets, or cash pickup. These services have gained popularity due to faster transfer times, lower fees, and more competitive exchange rates compared to traditional banks. They strive to offer and maintain these advantages in order to remain competitive in the market.

While these digital platforms offer many benefits, it's important to consider the varying security measures, regulatory compliance, and potential limitations based on the provider.

When it comes to sending money from the UK to Canada, there's no one-size-fits-all solution. The method you choose will depend on factors such as how quickly you need to send the money, whether you want to minimise fees, or whether your recipient has a bank account or prefers to receive cash. Additionally, the amount you're sending—whether large or small—can influence your decision.

Below, we’ve highlighted five popular methods for transferring money to Canada, each catering to different needs. We’ll also break down the speed, fees, and transaction limits for each, so you can choose the best option based on your requirements.

UK banks provide traditional methods for transferring money to Canada, typically via the SWIFT network. This process involves transferring funds from a UK bank account to a recipient's Canadian bank account.

Major UK banks, such as Barclays, HSBC, Starling Bank and Lloyds, offer international transfer services.

Start by visiting your bank’s website, mobile app, or branch to inquire about international transfer options. While most banks offer this service, not all do. If available, you'll need to provide the recipient's Canadian bank details, such as their account number, bank name, and the SWIFT/BIC code, depending on the system used.

You’ll then need to specify the amount you want to send, either in GBP or another currency, depending on your account type or the services offered. After confirming the transaction, check with your bank about who will cover any extra fees, especially if third-party banks are involved. Some banks like Barclays use the "OUR" payment option by default, meaning you'll cover all the fees. However, this isn’t the case with all banks, so it's best to ask. This will help avoid the issue where the recipient gets less than expected because fees are deducted from the amount sent, rather than charged to you, the sender.

The fees for international transfers vary among UK banks. Here are some examples from the big UK banks for reference:

Paying online typically incurs lower fees, while branch payments are usually more expensive.

The fees above do not factor in monthly bank account fees, minimum balance requirements, currency conversion fees (potentially ranging from around 1.5% to 3.5% or more), or intermediary bank charges if the banks involved do not have a direct relationship.

The fees listed here are based on the website as of January 2025 and may change over time.

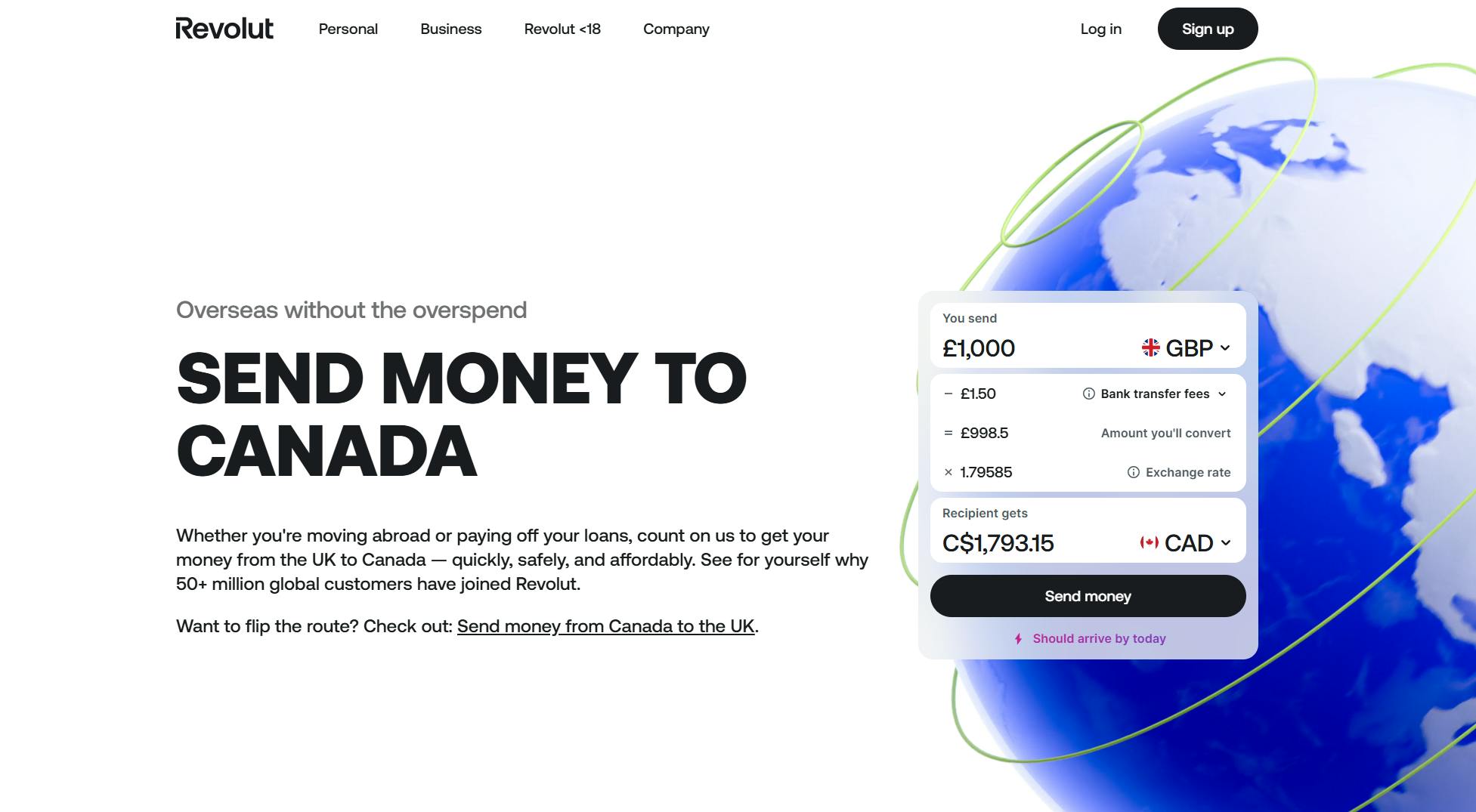

Revolut is a British multinational digital banking platform offering a comprehensive range of banking services for both individuals and businesses. It recently received a banking license in the UK.

You can use Revolut to send money from the UK to Canada for various purposes, whether you're supporting your family, moving abroad, paying off student loans, or starting a business.

Download the Revolut app, sign up, and top up your account via bank transfer, card, or other methods. Select Canada as your destination, enter the amount in GBP or another supported currency, and add your recipient’s details. Choose their currency (CAD or one of 70+ options), then tap "Send."

Alternatively, you can use a payment link—just share the recipient's phone number or email. They can claim the money, even without a Revolut account.

You can use Revolut fee calculator to estimate the fees.

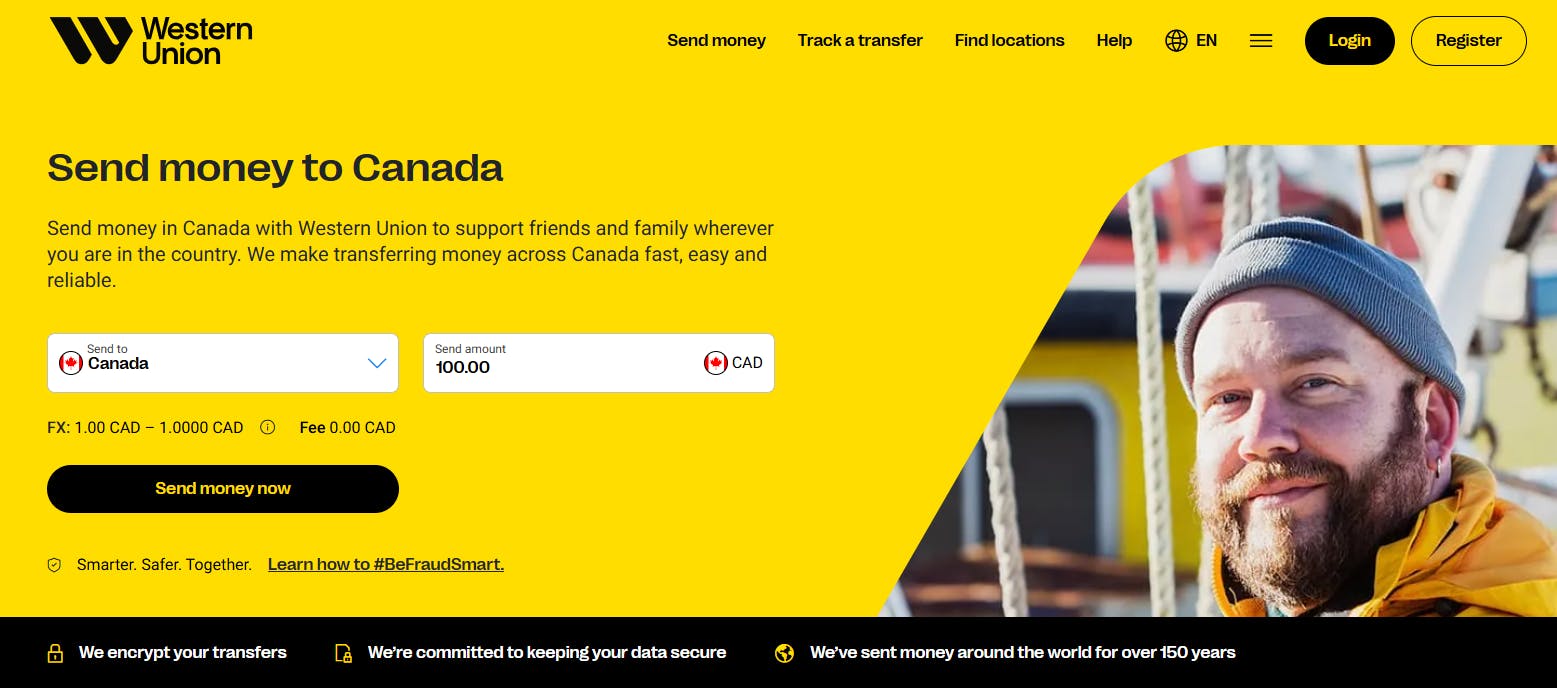

Western Union, an American financial services company, facilitates global money transfers through electronic transactions and in-person cash pickups at its vast network of agent locations.

For those in the UK, Western Union simplifies sending money to Canada, supporting major banks like the Royal Bank of Canada and the Bank of Montreal for direct deposits to recipients' bank accounts.

Create a free Western Union account or log in to an existing one and click “Send now.” Select Canada as the destination, enter the amount, and provide recipient details. Choose a payment method, review the transaction time, and complete your transfer.

If you wish to send money using a cash pickup service, visit a nearby Western Union agent location in the UK with a valid ID, your receiver's bank details, and proof of funds (e.g., bank statement or payslip). Pay using cash or a debit/credit card. You’ll receive a receipt with a tracking number (MTCN) to share securely with your receiver for tracking and collection.

As of January 2025, Western Union's transfer fees start from GBP 0 when you pay online and range from around GBP 3.90 to GBP 51.90 for cash pickups. For all methods, Western Union profits from currency conversion by applying a markup when converting GBP to CAD.

Western Union’s actual fees for transferring money from the UK to Canada depend on the chosen sending and receiving methods. You can use Western Union price estimator tool to check transfer fees and GBP/CAD exchange rates in advance. However, keep in mind that the exact fee will only be shown when you initiate the transfer.

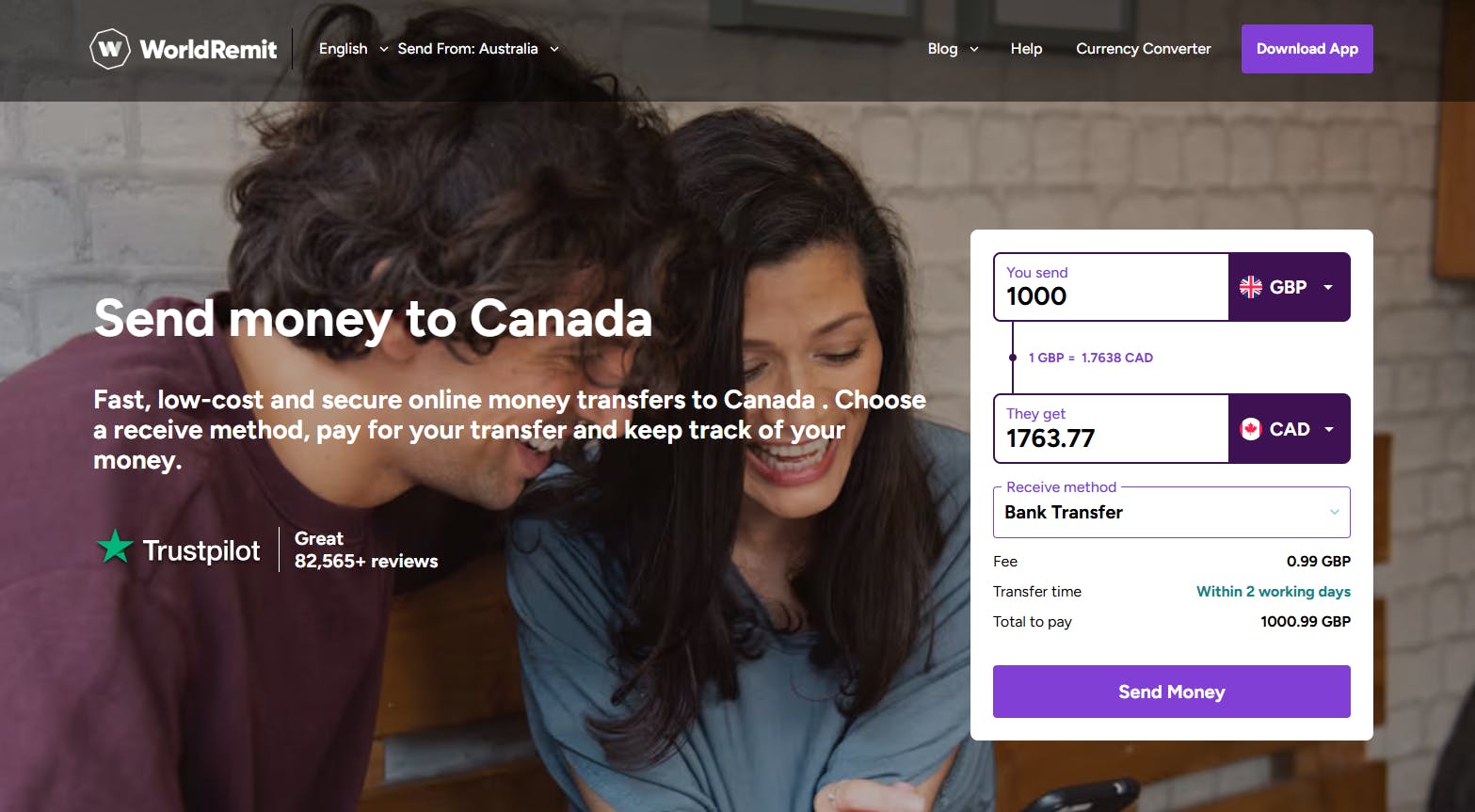

WorldRemit is a money transfer service headquartered in London, designed to help individuals send money to friends and family across the globe.

WorldRemit is known for supporting money transfers to many countries in Africa, but it also offers services to other countries worldwide, including Canada. It offers a simple and convenient way to send money.

Start by creating an account using your email, mobile phone number, and basic personal information, either on the app or website. Verify your phone number with an OTP. You may also need to provide ID proof and a selfie for identity verification, which typically takes no more than 4 minutes.

Next, initiate the transfer by selecting Canada as the recipient country, entering the amount, and choosing the preferred method for receiving the funds. You’ll be able to view the fees and exchange rates in the process. Afterwards, provide your receiver’s details and pay for the transfer either through a bank transfer to WorldRemit’s account or using a debit/credit card for quicker processing.

Fees start from GBP 0.99 as of January 2025. It's important to check both the transfer fee and the exchange rate, as they may affect the total cost. To get an estimatation, it's recommended to use WorldRemit Calculator.

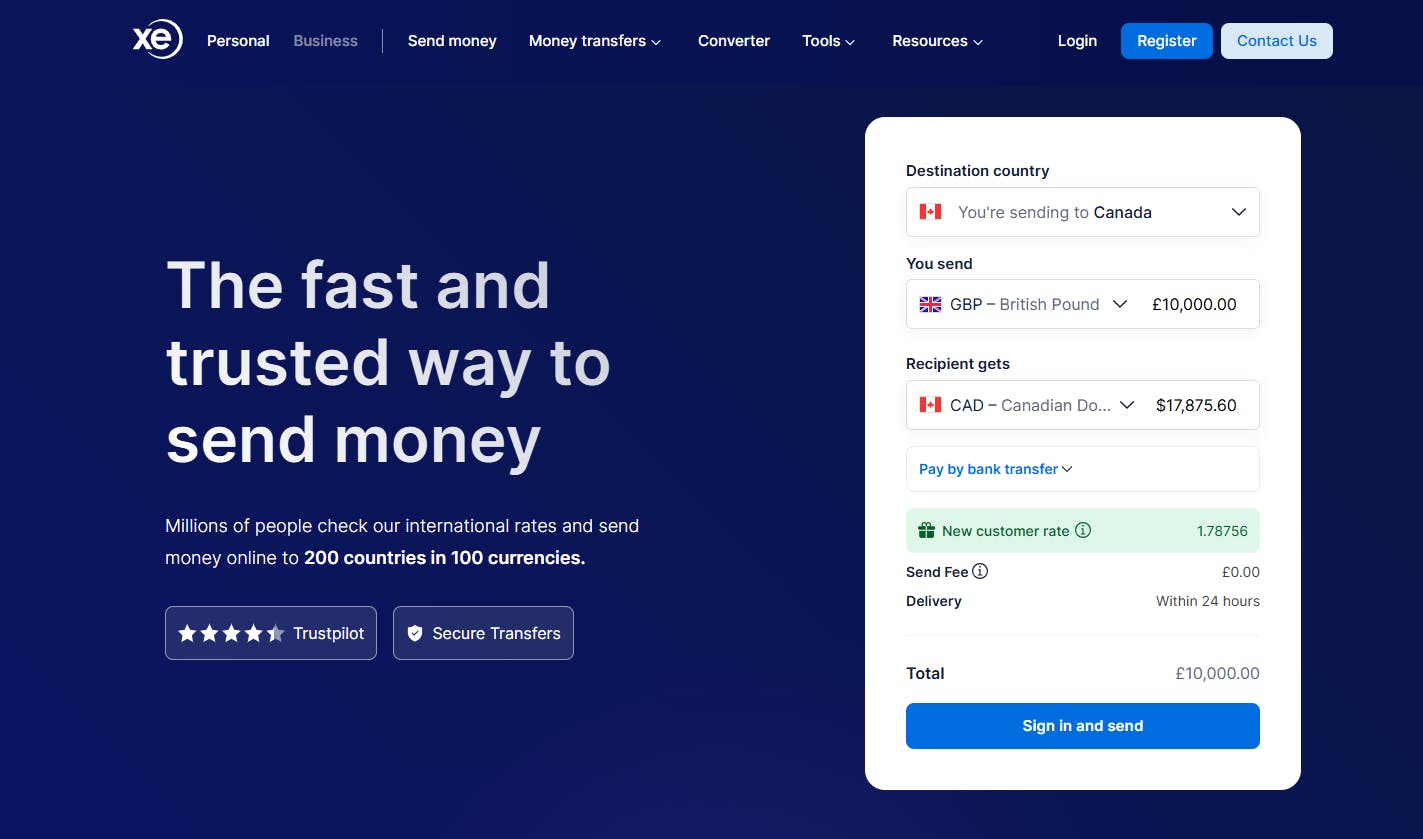

Xe, a Canada-based company, is well-known for its online currency converter and foreign exchange services. It also provides international money transfers and other currency-related services through its website and mobile apps.

Xe is a great choice if you're looking to save on exchange rates when sending money to Canadian bank accounts from the UK.

First, sign up for a free account by providing your email and some basic information. Then, select the currency and amount you wish to transfer, along with the destination. Xe will outline the fees and exchange rates in the process. Once you’ve reviewed the details and delivery times, confirm and fund your transfer. Xe will keep you updated throughout the process.

Estimated fees start at GBP 0 - GBP 3, and the more you transfer, the lower the Xe fees. Additional costs, such as bank transfer fees, may apply, and you’ll need to consider the exchange rate. There isn’t a fixed fee because it varies depending on several factors, but you can use the Xe fee calculator available on its landing page: Xe Money Transfer to Canada.

Whether you’re using a traditional bank transfer, an online service, or a cash pickup provider, there are essential details you’ll need to ensure the process goes smoothly. While these requirements may vary slightly depending on your provider, the core information typically remains the same:

For Bank Transfers or Online Transfer Services:

Depending on the provider and how the transfer is delivered, the details you need might vary slightly. However, most services will require the following:

The transit number and institution number are located at the bottom of the bank’s cheque.

For Cash Pickup Services:

The time it takes to send money from the UK to Canada depends on the method.

Bank transfers typically take 1 to 5 business days. Online services usually complete transfers in 1 to 3 business days, with debit or credit card payments speeding up the process to minutes. Cash pickup transfers can be available in minutes to a few hours but may come with higher fees.