HK

HK

Banking Insights

5 Min

Are you looking for the best way to send money to Thailand in 2025? With so many services available, how do you know which one is right for you? Whether you’re sending money to support loved ones, cover travel costs, or handle business payments, this article has you covered.

We will discuss five top options, focusing on their features, benefits, and drawbacks. By the end, you will know what each service offers and how to choose the best one for your needs.

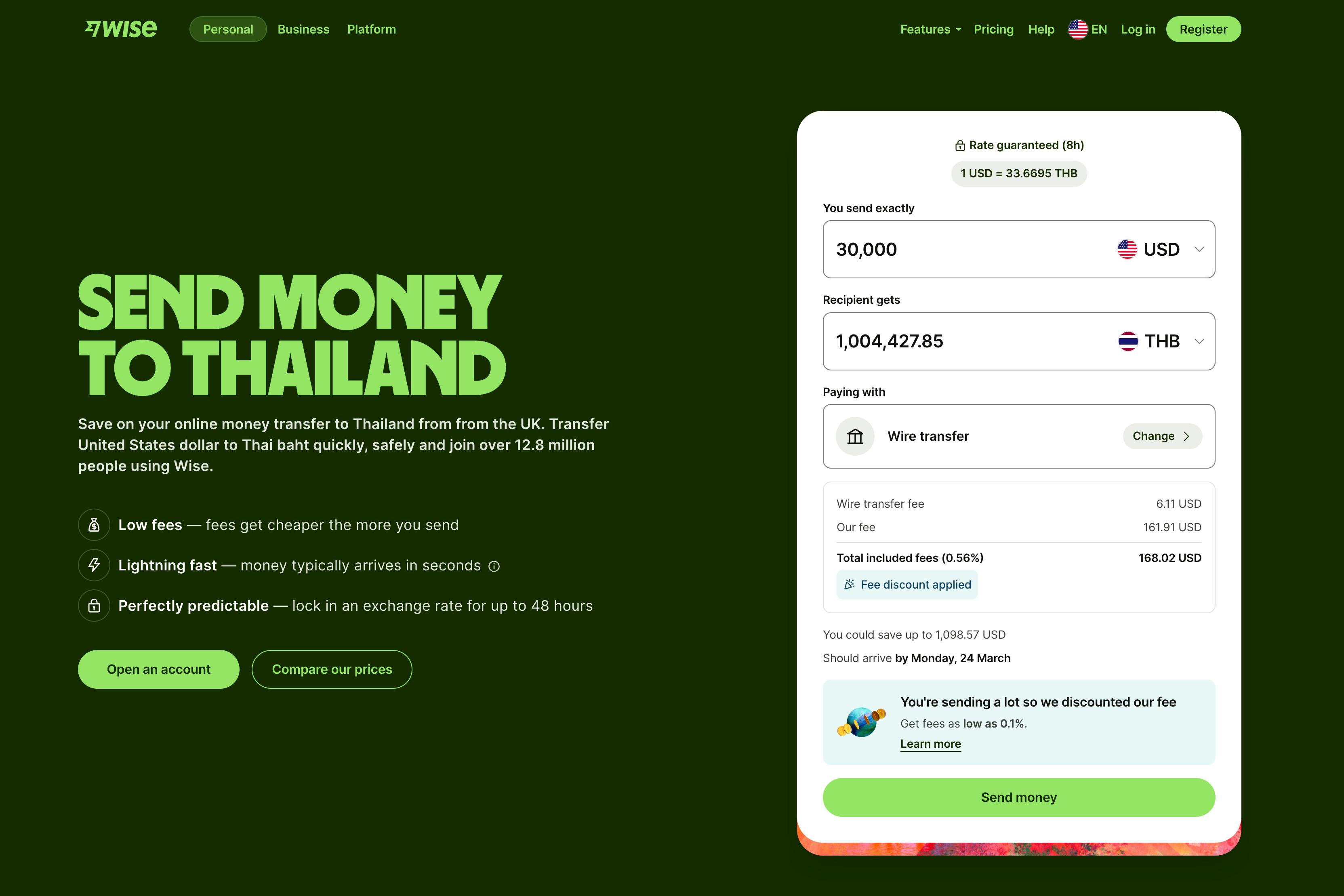

Wise, formerly known as TransferWise, is a UK-based company founded in 2011 with the aim of making international money transfers simple and fair. The company’s platform addresses common issues like hidden fees and poor exchange rates by using real mid-market exchange rates with no markups.

This approach ensures users get great value. Wise has become a trusted option for individuals and businesses thanks to its transparent pricing, user-friendly platform, and fast transfer times.

Wise is perfect for individuals and businesses looking for a cost-effective and reliable way to send money internationally.

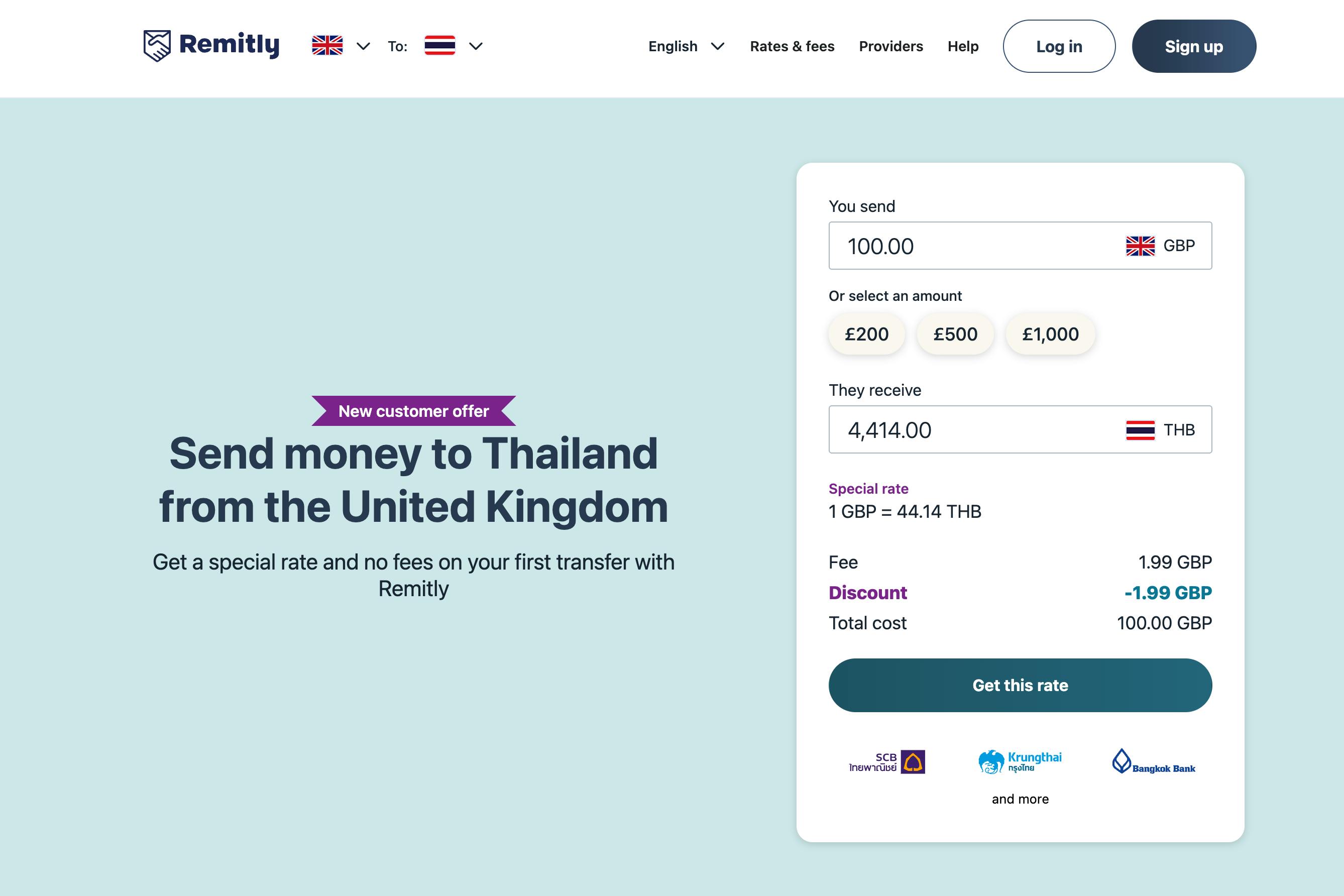

Established in 2011 in Seattle, Remitly has become a leading name in remittance services tailored for those who need flexibility in how money is sent and received. It offers two main transfer options: Express, for near-instant transfers, and Economy, which takes a little longer but comes with lower fees.

Whether you’re sending money to a bank account or opting for cash pickup, Remitly makes the process straightforward. A promotional zero transfer fee for first-time users adds to its appeal, especially for those new to international money transfers.

Remitly is best for users needing speed or flexibility, such as those requiring cash pickup options or urgent transfers.

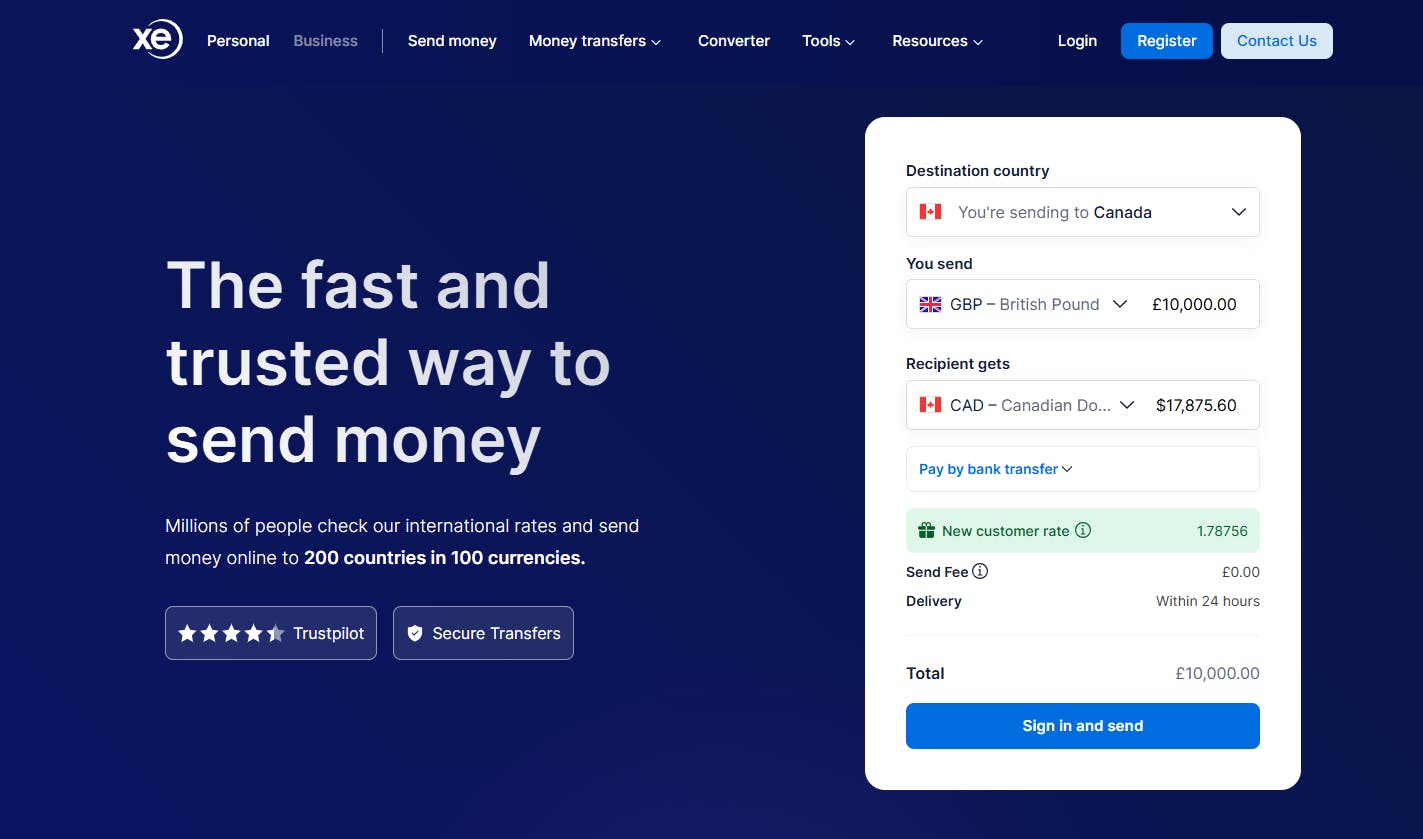

XE Money Transfer is part of Euronet Worldwide and has been a leading name in currency exchange and money transfers since 1993. The platform caters to both individuals and businesses, offering services in over 60 currencies.

The platform is easy to use, whether you’re transferring funds online or via the XE mobile app. XE’s balance of simplicity, speed, and cost-effectiveness makes it a strong contender for regular money transfers.

XE is best for those looking for affordable transfers directly to bank accounts.

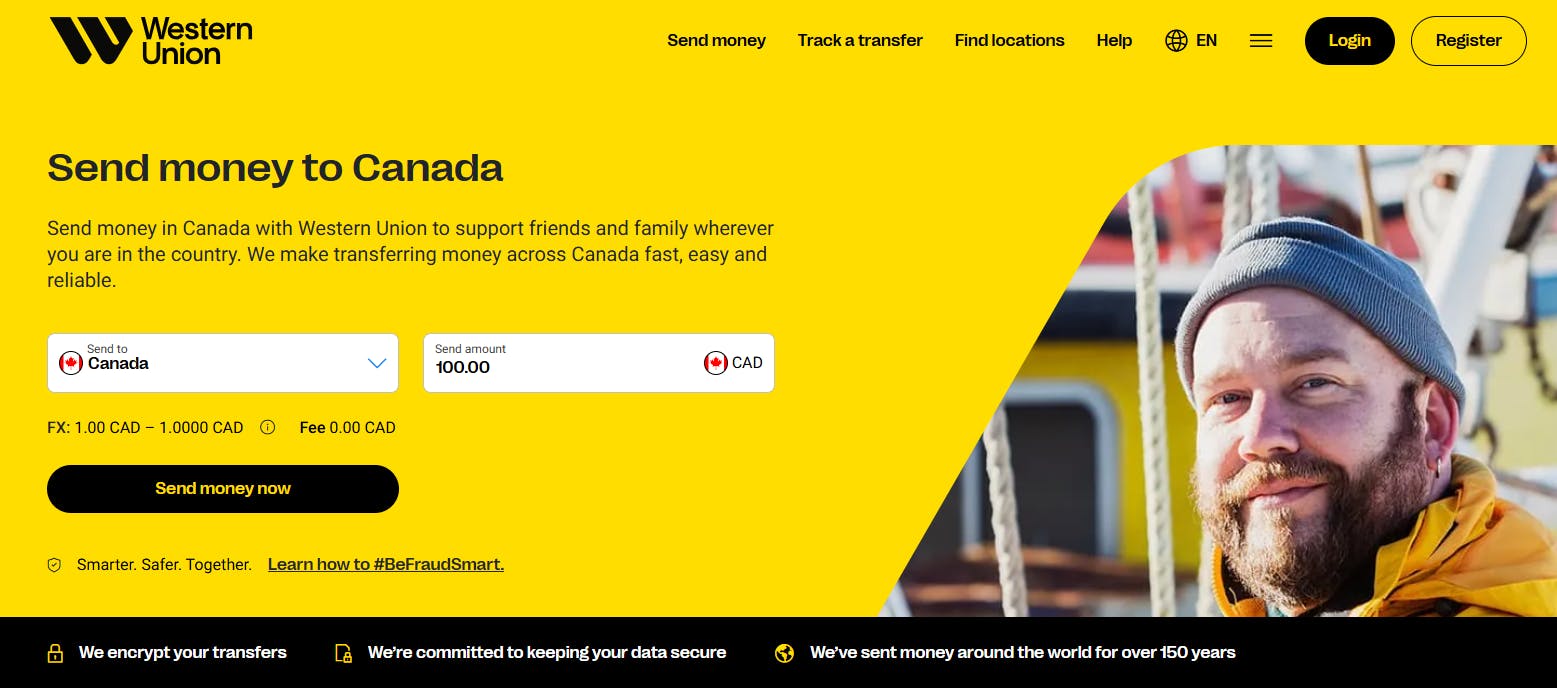

Western Union is a global financial services company with a history spanning over 170 years. Based in the United States, it has one of the largest networks of agent locations worldwide, making it a household name in money transfers.

With the ability to send funds both online and in person, Western Union provides flexibility for both the sender and recipient. However, the service’s fees and exchange rates can vary depending on the transfer method and speed, so it’s important to compare costs before committing.

Western Union is ideal for people who need a fast transfer or a cash pickup option, especially in areas with limited banking facilities.

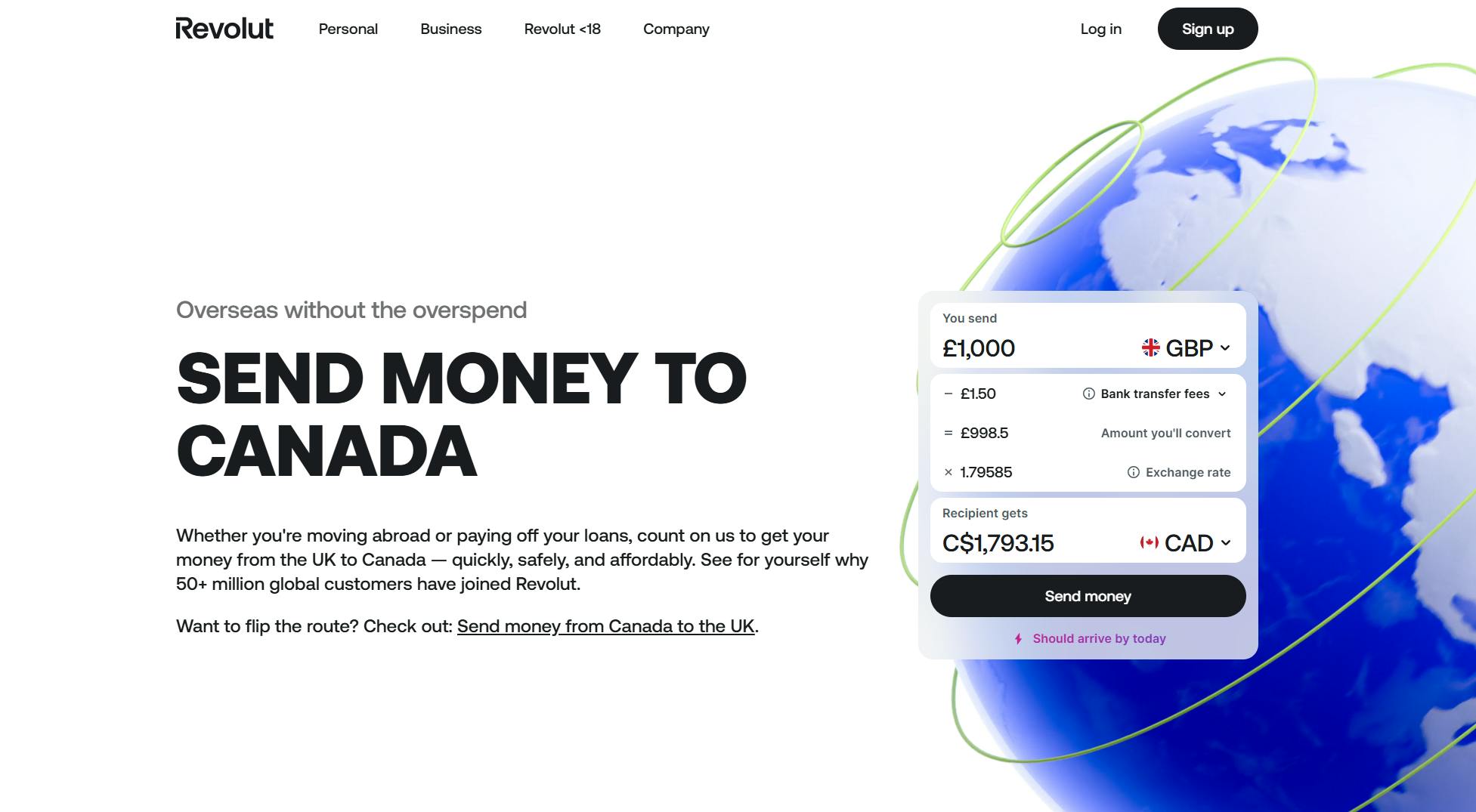

Revolut is a UK-based digital bank that has gained popularity for its fast, low-cost international transfers. Designed for modern users, Revolut provides a seamless way to send money globally through its app.

The platform supports multiple currencies, and users can take advantage of its fee-free transfer limits for smaller amounts. However, it’s important to note that exceeding the monthly free transfer cap can lead to additional fees.

Revolut is perfect for tech-savvy individuals who want a fast and low-cost way to send money abroad.

Focus on these tips when choosing the best provider for sending money to Thailand.

When choosing a provider to send money to Thailand, think about what matters most to you. Do you want quick delivery, low fees, or flexible payment options? By understanding your needs and comparing providers, you can find the best option for your transfer.